Variable Overhead Efficiency Variance Definition, Formula, Example, Calculation, Explanation

By using standard cost against both the actual and expected quantity, we get the variance in dollars that is attributed to quantity only. The standard hours are the total number of hours required by the company’s standard hours of the specific product to complete the production target during a particular period. The variable production overhead efficiency variance is exactly the same in hours as the direct labour efficiency variance, but priced at the variable production overhead rate per hour. Similarly, a favorable variable overhead efficiency variance is when the employees do the required work in a lesser time than what was budgeted. Before we go on to explore the variances related to fixed indirect costs (fixed manufacturing overhead), check your understanding of the variable overhead efficiency variance. While if the actual hours worked are higher than the budgeted hours estimated by management, we called it unfavorable variance.

What is Variance Analysis? Definition, Explanation, 4 Types of Variances

When the actual output exceeds the standard output, it is known as over-recovery of fixed overheads. The variable overheads are based on the previous production practices, estimated working hours that will be required in the coming year, and the capacity level of the company. Standard hours and actual hours can be labor hours or machine hours depending on which measurement is more suitable. For example, if the manufacturing process depends more on manual work, labor hours may be more suitable. On the other hand, if the work is mostly automation in the production process, the machine hours may be used instead as it is more suitable in this case. Avariance in variable overheads may typically arise due to a sudden increase ininflation rate or maybe due to a change in supplier of indirect materials atthe eleventh hour.

Formulae using Inter-relationships among Variances

The Variable Overhead Efficiency Variance is the difference between the standard cost for actual output and the standard cost for actual input. Since the calculation of variable overhead efficiency variance is not influenced by the method of absorption used, the value of the variance would be the same in all cases. Hours refers to the number of machine hours or labor hours incurred in the production of output during a period. turbotax itsdeductible This is the portion of volume variance that is due to the difference between the budgeted output efficiency and the actual efficiency achieved. By contrast, efficiency variance measures efficiency in the use of the factory (e.g., machine hours employed in costing overheads to the products). The Variable Overhead Efficiency Variance is the difference between the absorbed cost and the standard cost for actual input.

Get in Touch With a Financial Advisor

- The company can calculate variable overhead efficiency variance with the formula of standard hours budgeted deducting the actual hours worked, then use the result to multiply with the standard variable overhead rate.

- And that’s why the efficiency graph goes higherand in the end, the result is a favorable one.

- So, the company ABC has a $400 favorable variable overhead efficiency variance in September.

- For example, the quantity of diesel oil utilized is estimated based on previous production units.

Total overhead cost variance can be subdivided into budget or spending variance and efficiency variance. (c) In addition, prepare a reconciliation statement for the standard fixed expenses worked out at a standard fixed overhead rate and actual fixed overhead. Similarly, indirect labor salaries and wages, including factory supervisors and guards, are estimated.

Calculate Variable Overhead Efficiency Variance

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

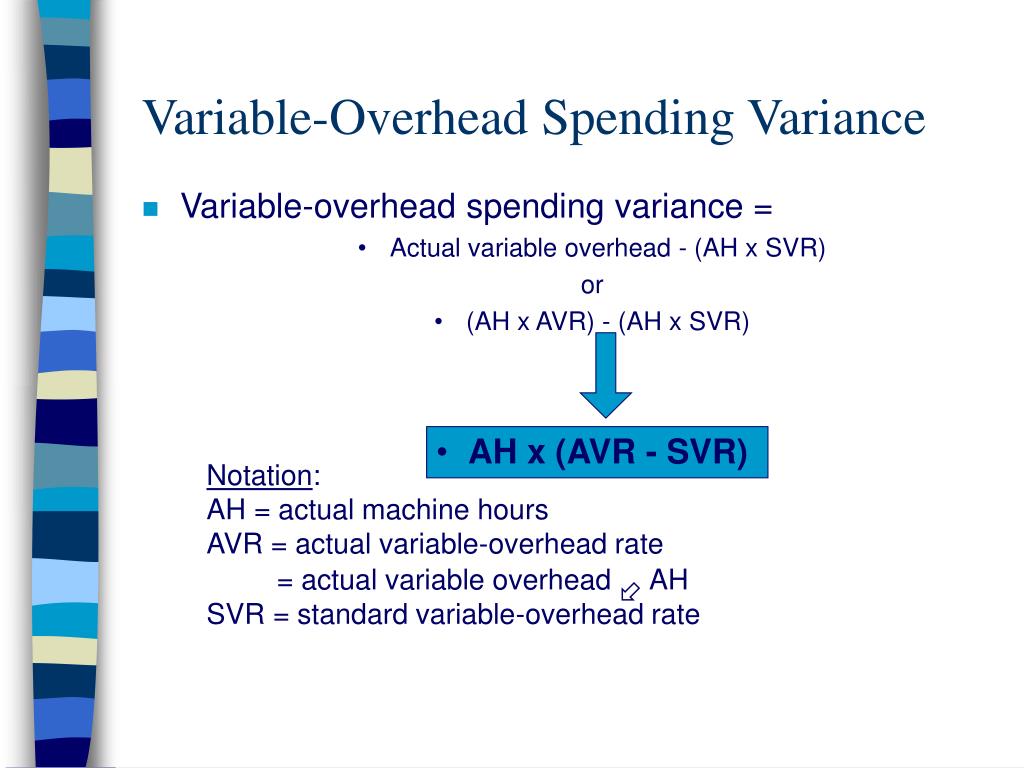

If actual labor hours are less than the budgeted or standard amount, the variable overhead efficiency variance is favorable; if actual labor hours are more than the budgeted or standard amount, the variance is unfavorable. Variable Overhead Efficiency Variance is calculated to quantify the effect of a change in manufacturing efficiency on variable production overheads. As in the case of variable overhead spending variance, the overhead rate may be expressed in terms of labor hours or machine hours (or both) depending on the degree of automation of production processes. As the name suggests, variable overhead efficiency variance measure the efficiency of production department in converting inputs to outputs. Variable overhead efficiency variance is positive when standard hours allowed exceed actual hours. Therefore a positive value is favorable implying that production process was carried out efficiently with minimal loss of resources.

Standard hours are the number of hours that the company’s workforce is expected to spend during the period or to spend in completing a certain number of units of production. This type of variance is calculated separately for direct variable expenses and overhead variable expenses. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Actual hours are the hours that the company’s workforce actually spends during the period or actually spends to complete a certain number of units of production. Remember that both the cost and efficiency variances, in this case, were negative showing that we were under budget, making the variance favorable. Even though the answer is a negative number, the variance is favorable because we used less indirect materials than we budgeted. Variable overhead efficiency variance refers to the difference between the true time it takes to manufacture a product and the time budgeted for it, as well as the impact of that difference.

This is a portion of volume variance that arises due to high or low working capacity. It is influenced by idle time, machine breakdown, power failure, strikes or lockouts, or shortages of materials and labor. This example provides an opportunity to practice calculating the overhead variances that have been analyzed up to this point.