Single Column Cash Book Format, Calculation, and Example

In the ‘Date’ column, the day, month and the year, on which transaction occurs should be recorded. As this explanation indicates, the cash book is among the most important books of accounts in modern business. The balance of cash in a cash book can be recorded in 2 ways.

Open Cheque

Under bank column of the cash book, cash transactions routed through bank are recorded. Simple cash book with single amount column on either side is maintained if the organization has only cash transactions. However, due to security and legal bindings, sometimes the transactions have to be necessarily routed through banks. The receipt issued by the cashier is the source document for cash receipts. There are primarily three types of cash books i.e. single column, double column, and triple column. But if you include petty cash books too, there are four types of cash books.

Analytical Petty Cash Book

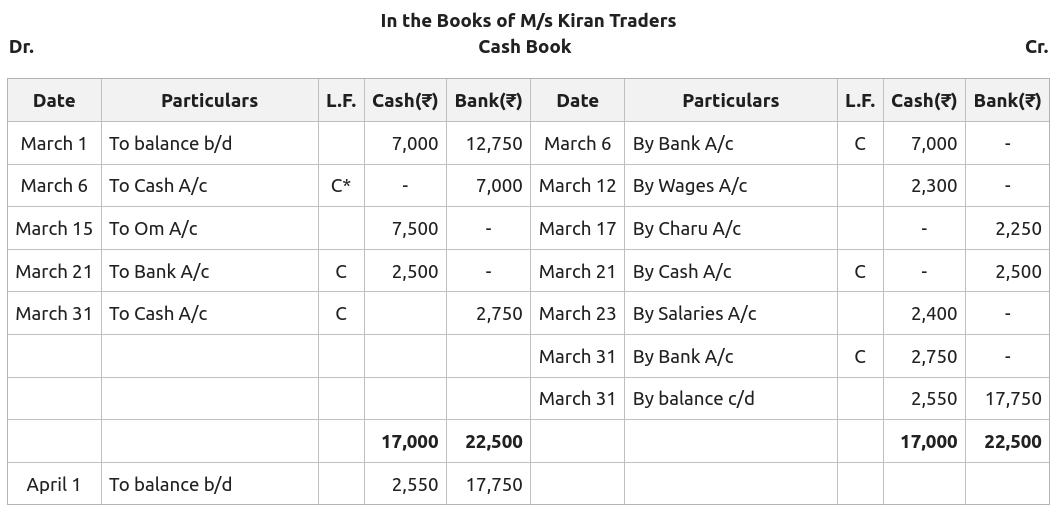

Three column cash book records three types of accounts, i.e., cash, bank and discount. This substitutes the creation of cash account, bank account, discount received and discount allowed in the ledger. Although single and double column cash books are alternatives to a cash account, the three column cash book serves the purpose of cash as well as a bank account.

- This is the reason why it is called a single column cash book (or a simple cash book).

- The total amount spent and the amount reimbursed shall be shown in the total amount column.

- To illustrate, for a company receiving cash payment for sales, entries will be made both in the sales ledger and the cash book.

- This could include money that is received, paid out, and even deposited into or withdrawn from a bank account.

- These cheques can be replaced if lost or stolen, providing peace of mind during travels.

Functions of the Columns in a Single Column Cash Book

The petty cashier receives cash against the cheque from the bank and records the cheque in the receipts column of the petty cash book. A single-column cashbook records only transactions involving the exchange of actual cash in hand. A double-column cashbook records both cash and bank transactions. Here instead of one column, we have an additional column for discounts. So along with the cash transactions, we will also record the discounts in the same cash book.

2.It helps in creating a regular record of transactions date wise for the convenience of accounting personnel. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

How does a single-column cash book differ from a double-column cash book?

The bank transactions and the discounts that are given for transactions will be featured in separate ledger accounts in case of single-column cash books. This is the main area where businesses record any and all cash-related information. Entries are normally divided into cash payments and receipts. A double-column cash book includes separate columns for recording receipts and payments, while a single-column cash book combines both types of transactions into one column. As such, the single-column cash book provides less detailed information than the double-column cash book.

The amount of the transaction is recorded in the final column. At the end of each month, when the petty cashier approaches the main cashier for reimbursement, the latter will prepare a cheque voucher. Under the imprest system, total petty expenses for a specific period are estimated and the amount is advanced to the petty cashier. Under this system, the petty cashier is given a lump sum to meet petty expenses. When the whole amount of petty cash is spent, the petty cashier submits the account to the chief cashier who again pays a lump sum to the petty cashier. By specifying the amount, recipient, and date, cheques help reduce misunderstandings in financial transactions.

A cash book with three columns for discounts received and paid, cash transactions, and bank transactions is known as a three column cash book. Also known as a two column cash book, a double column cash book is the one which has a “Bank” column in addition to the regular “Cash” column. Just like the other type of books, it records receipts from cash and bank on the left side and payments – on the right side. Alternatively the business can use the additional column of the two column cashbook ledger to operate as a bank journal. Conversely, all cash payments, including rent, payroll expenses, and vendor payments, are entered on the right/credit side. A cash book is a chronological financial record of all the cash transactions of a business involving cash receipts and cash disbursements.

This is the reason why discount columns are also provided in the cash book. Now total amount under the ‘Amount’ columns on both side of the cash book is written opposite to each other. The closing balance shown as ‘By Balance c/d’ becomes the opening balance for the next period and is written as ‘To Balance b/d’. In the ‘Particular’ column, the nomenclature of the accounts, from where cash is received or paid, gets recorded.

When money is received, an original receipt is given to the payer and the payee retains a copy. The letter «C» indicates that the contra effect of this transaction is recorded on the opposite side. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. accounts payable duplicate payment audits A financial professional will be in touch to help you shortly. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Check with your bank for details about any applicable charges. The MICR (Magnetic Ink Character Recognition) code is a 9-digit number at the bottom of every cheque. It uniquely identifies the bank and branch issuing the cheque, facilitating faster and more accurate cheque processing through automated systems. The MICR code ensures the smooth clearing of cheques across the banking network. Cheque books come with built-in security features that protect against fraud.