Breakeven Analysis Calculator

That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses. In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures. This computes the total number of units that must be sold in order for the company to generate enough revenues to cover all of its expenses.

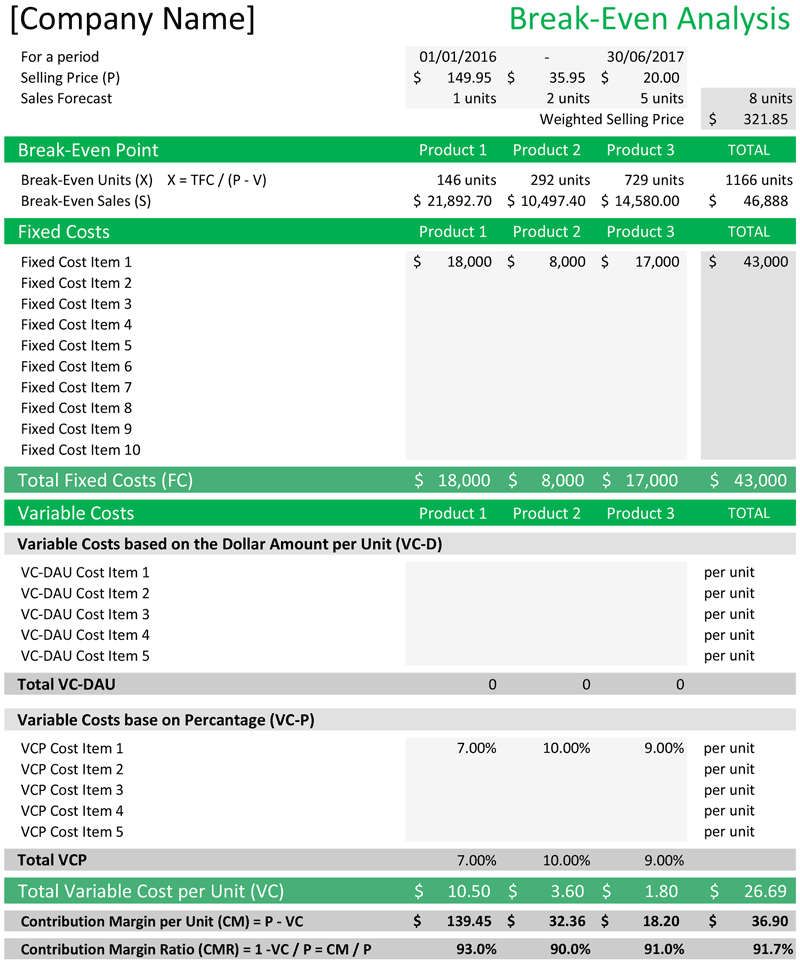

Calculating the break-even point in number of units

This could generate higher total profits, even if the profit per product is cheaper. Note that your BEP will change as your sales volume for the product and the unit price changes. Whether you have a large or small company, paid telephone bill journal entry analyzing the break even point is a crucial part of business finance. Though breaking even may not seem much of a goal, it’s an important standard that tells you when your revenues have covered your expenses.

See profit at a glance

- One limitation of break-even analysis is that it assumes selling prices will stay the same over time.

- The following break-even point analysis formulas will help you get there.

- Remember that marketing is a process that entails planning and reaching goals.

The BEP is the number of units that you must sell for a deal or business to break-even. Or perhaps you are an Uber driver who wants to know your break-even point. In that case, your BEP is the average number of trips you must make.

Business Resources: Staff and Materials

It’s also important to screen and hire quality employees that would help the business thrive. But of course, outsourcing labor to cheaper countries isn’t the only solution. If you can find a local supplier that provides a good deal, that’s even better.

Join Local Business Organizations

If you are an Uber driver and you enter for the selling price per unit the average price per trip, then your BEP is the number of trips you must make. You might want to add new products to sell to reach the break even point. This can be particularly useful if you are considering break even from an overall business perspective. Increasing product lines may be a cheap solution (say you have a shop or warehouse, adding more product lines will likely add little to your holistic operational costs).

It allows you to expand your network based on customers who have been satisfied with your service. While you may assume regular clients spread a good word of mouth, it still pays to proactively ask for referrals. In research done by Amplifinity, they found that verbal referrals produced the best results with a 32% success rate. If you’re not used to requesting referrals, make it a habit, most appropriately after completing a service.

And if you’ve been working with a supplier for a while, consider negotiating with them. Ask if there’s a way they can help reduce the price of your raw materials. Try to push for lower rates, especially if you’ve been working with them for many years. They just might agree to lower the cost to keep you as their client.

Besides ads and social media posts, here are several effective marketing practices that help increase sales. Before the internet and social media, small businesses would usually place ads on local newspapers and directories. Companies with bigger budgets spend on above the line ads such as TV commercials and billboards. But these days, almost every type of business takes advantage of social media platforms to reach their consumers.

Companies should proceed with caution every time they decide to increase prices. More often, it could mean losing a chunk of consumers who purchase your product because of affordability. Before increasing the price, you must conduct surveys and market research. It’s also important to check your competitor’s prices and any unique features to their products. But if the market allows it, you can certainly increase your price up to a level that consumers will keep buying. Our free version of the online break-even calculator allows you to quickly obtain the break-even point for a single product, as well as the profit generated for a given level of sales.

When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. While gathering the information you need to calculate your break-even point is tricky and time consuming, you don’t have to crunch the numbers with just a pen and paper.

The answer to the equation will tell you how many units (meaning individual products) you need to sell to match your expenses. Upon doing so, the number of units sold cell changes to 5,000, and our net profit is equal to zero. Remember, the break-even point is the number of units you must sell so that your business has neither a profit nor a loss. If you’re looking to purchase a specific machine or a truck for your business, consider taking an equipment loan.